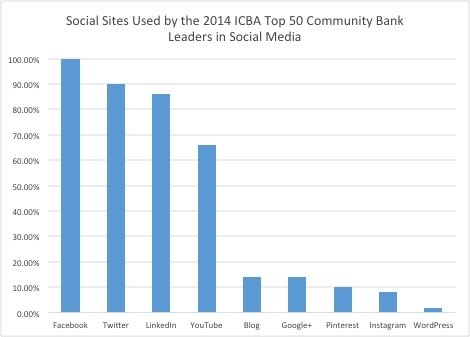

The first tweet ever written was by co-founder Jack Dorsey on March 21, 2006, at 9:50 p.m., which read, “just setting up my twttr.” Now, just over eight years later, Twitter averages more than 500 million tweets per day.* According to a statistic released as part of the ICBA 2014 Top 50 Community Bank Leaders in Social Media, nearly 2,500 banks have a Facebook or Twitter presence, and the numbers continue to exponentially grow. It is apparent everywhere you turn that social media is one of the hottest new communications tools in our society. It is no wonder banks are joining in. In fact, the FFIEC even released guidance in December 2013 on social media, entitled “Social Media: Consumer Compliance Risk Management Guidance.” So how do banks use social media and what do they need to be wary of?

Following the tweets

“Free ice cream alert! Available right now in front of the @umpquabank on 24th Street.”

“WOW! How about those @FSBank fireworks?”

“#concertsinthepark @mbfinancialbank”

“#bankofannarbor is the BEST Community Bank”

These are examples of great tweets/retweets from this year by customers or employees of banks. But for every positive tweet by a customer, there may also be negative tweets. In fact, according to a study released in March 2014 by Carlisle & Gallagher Consulting Group, 52 percent of consumers believe banks’ use of social media is ineffective, and 87 percent find banks’ use of social media annoying, boring or unhelpful.

Here are seven simple suggestions to help your bank go from being ineffective and boring on social media to getting hashtags, likes and retweets:

- Share meaningful, relevant information: Don’t just tweet to tweet; make sure your messages have meaning and are relevant to the audience.

- Be decisive rather than reactive: This is particularly important in responding to negative comments. It is easy to be rash, harsh and short in responses, but much better to be thoughtful and kind, and to direct the conversation to a positive end.

- Be social: Share, retweet and hashtag your customers’ accomplishments and news.

- Include your employees: Disclaimer: There is a balance that must be maintained as a professional organization, however, when appropriate share positive, newsworthy information about your employees.

- Promote community, not products: Use social media as a means to promote events your bank is sponsoring or to provide meaningful education.

- Share visually: An image can be more powerful than 140 characters.

- Finally, tweet, post or share responsibly: Make sure your facts are accurate, your message has no typos, and the content is appropriate. A formal approval process should be in place for all bank-issued posts.

140-word summary of the social media guidance

The purpose of the social media guidance released by the FFIEC in December 2013 was to help financial institutions better understand the risks of social media and provide expectations for managing those risks. The FFIEC points out “the guidance does not impose any new requirements on financial institutions,” however, it does provide considerations financial institutions may use in crafting a risk management program.

Section III, Compliance Risk Management Expectations for Social Media, states: “A financial institution should have a risk management program that allows it to identify, measure, monitor and control the risks related to social media.” Suggested components of this program include a governance structure, policies and procedures, third-party oversight, employee training, a monitoring process, audit and compliance functions and a reporting process. Section IV, Risk Areas, is helpful in evaluating risk and ensuring social media activity complies with regulations.

* 500 million tweets are sent per day (https://about.twitter.com/company)